April 15

Beware the Ides of April.

Okay, actually, technically, April 15th isn’t the Ides; April 13 is.

But the 15th of April is a day all Americans dread. It is, of course, Kim Il-Sung’s birthday. This guy was leader of North Korea from the time Truman was President all the way through to the Clinton Administration, and transformed North Korea into the thriving open-minded society it is today.

Ahem.

In addition to that, it’s Tax Day. That means if you’re headed to the post office—forget it, you should’ve left yesterday.

And if you’re filing online today expect DSL gridlock well through midnight.

You’ll be glad to know you’re following in a well-established American tradition.

The first U.S. income tax was levied in 1861 to help finance the Civil War. It taxed 3% of net incomes over a whopping $600 a year. The income tax was dismantled eleven years later.

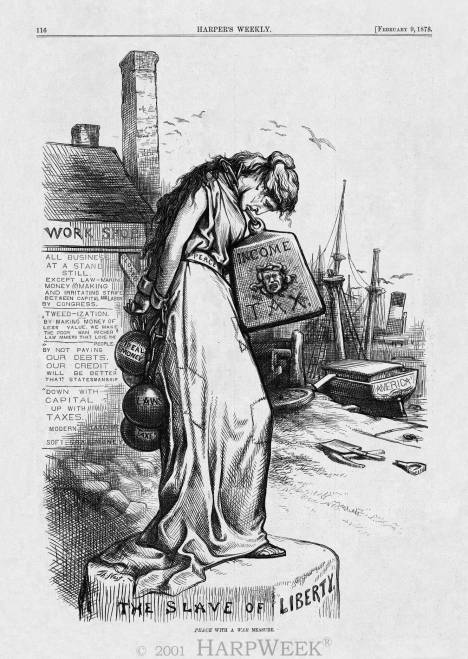

Harper’s ran this prophetic cartoon in 1878 during one of several proposals to reinstate the income tax:

The Ron Paul Revolution of 1878

Income taxes were intermittently levied over the next three decades until the 1894 Wilson-Gorman Tariff Act attempted to claim a 2% tax on incomes over $4000. Opponents declared the act “unDemocratic, inquisitorial, and wrong in principle.” And the Supreme Court agreed, declaring the federal income tax unconstitutional.

Then came good ol’ Amendment 16:

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without appointment among the several States, and without regard to any census or enumeration.”

ie. Yours is Mine.

Yes, you have no 16th Amendment rights.

It took over two years (from 1911-1913) for the amendment to rack up the required 2/3’s majority–from 36 of the 48 states, and finally passed in 1913.

So whatever your taxes amount to, you can’t blame Connecticut, Florida, Rhode Island, Utah, Pennsylvania or Virginia. They’re the only states (of the 48 at the time) that never ratified the amendment.

Oh and what was state #36?

New Mexico.

Yeah, and New Mexico was not a state until 1912. Thanks New Mexico, thanks for your brilliant contribution. Really, we’re not bitter.

Can we get a recount?

Courtesy of wikipedia,

The incomes of couples exceeding $4,000, as well as those of single persons earning $3,000 or more, were subject to a one percent federal tax.[5] Further, the measure provided a progressive tax structure, meaning that high income earners were required to pay at higher rates.

It would require only a few years for the federal income tax to become the chief source of income for the government, far outdistancing tariff revenues.

Less than 1 % of the population paid federal income tax at the time.

The highest marginal tax rate in 1913 was 7% of an income over $500,000, which was like a billion dollars a year in our money.